Certificates of Deposit (CDs) are a popular investment choice for individuals looking to earn a stable return with minimal risk. This guide will explore strategies for finding the best and highest CD rates currently available in the market.

Understanding CDs

A Certificate of Deposit is a fixed-term deposit offered by banks and credit unions. When you invest in a CD, you agree to leave your money deposited for a specified term, which typically ranges from a few months to several years. In exchange for fostering this financial relationship, the bank pays you interest at a higher rate than standard savings accounts. According to the Federal Deposit Insurance Corporation (FDIC), the average rates for CDs can vary widely depending on the financial institution, term length, and other factors (FDIC, 2021).

The major appeal of CDs lies in their guaranteed returns. Unlike stocks or mutual funds, which fluctuate with market conditions, CDs secure your principal investment while allowing it to grow at a predetermined interest rate. The trade-off is liquidity; funds placed in a CD cannot be accessed without penalty until the term matures.

How to Find the Best CD Rates

Research and Comparisons

The first step to securing the best CD rates is diligent research. Many financial websites specialize in comparing rates, making it easier for you to evaluate various options. Websites such as Bankrate, NerdWallet, and DepositAccounts provide comprehensive lists of current rates offered by different banks. It is essential to check these platforms regularly, as rates can change frequently based on economic conditions and Federal Reserve policies.

Consider Online Banks

One effective way to find higher CD rates is to look at online banks. According to a report from ValuePenguin, online banks often provide better rates than traditional brick-and-mortar banks due to lower operating costs (ValuePenguin, 2021). On average, online banks might offer 0.25% to 0.75% higher interest than physical banks for similar terms.

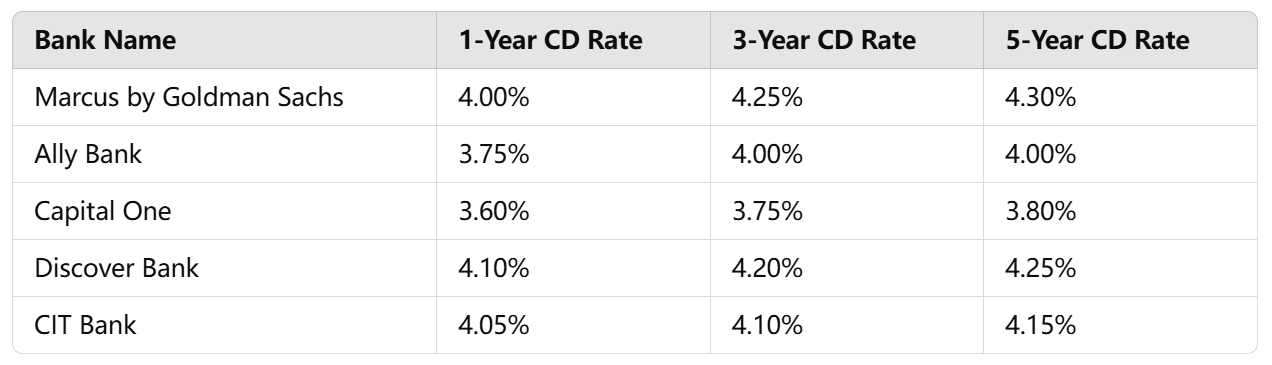

Here’s a comparison of some well-known financial institutions’ CD rates (as of 2023):

Flexibility and Terms

CDs come in various lengths, from a few months to several years. Generally, longer terms yield higher rates, but locking your funds for extended periods can be risky if interest rates rise after you invest. Consider the current economic climate and projected interest rate trends when selecting the term that best suits your financial goals.

For those who wish to take advantage of fluctuating interest rates, “bump-up” CDs can be a viable option. These allow you to adjust your interest rate once during the term if market rates increase. Such features can provide a hedge against falling behind other investment opportunities.

Negotiation and Loyalty Programs

Don’t hesitate to negotiate rates with your chosen bank, especially if you are a loyal customer or have substantial funds to invest. Many banks are willing to match or beat competitor rates to retain customers. Building a relationship with your bank can yield benefits not just for CDs but for overall financial services.

Additionally, some banks offer loyalty programs that provide better rates for existing customers or those opening multiple accounts. If you already have a checking or savings account with a bank, inquire about exclusive rates for CD products.

Understanding APY and Early Withdrawal Penalties

While searching for the best CD rates, you should pay attention to the Annual Percentage Yield (APY). This rate reflects the total amount of interest you will earn on your deposit, considering compounding. A higher APY means more money earned in interest, so always compare the APY rather than just the nominal interest rate.

Be aware also of early withdrawal penalties, which are fees assessed when you withdraw your deposit before the CD matures. These penalties can significantly reduce your earnings, so ensure that the bank’s terms align with your liquidity needs. Most institutions typically charge a penalty of several months’ interest for early withdrawals.

Market Trends and Economic Conditions

The interest rates on CDs are influenced by broader economic trends. The Federal Reserve’s monetary policy plays a crucial role in determining rates. For example, when the Federal Reserve raises interest rates to combat inflation, banks typically respond by increasing CD rates to attract more deposits. Conversely, when the Fed lowers rates, CD rates tend to follow suit.

As of mid-2023, economists predict modest rate increases, suggesting it may be a good time to lock in higher CD rates before they potentially decline again. Monitoring economic indicators, such as inflation and the unemployment rate, can provide insight into future rate movements.

Conclusion

Finding the best and highest CD rates requires a combination of research, patience, and an understanding of the financial landscape. By considering online banks, comparing APYs, negotiating rates, and understanding market trends, you can make informed decisions that align with your financial goals. CDs can be an excellent choice for savers looking for a safe investment with guaranteed returns, especially when approached strategically.

References

Bankrate. (2023). Best CD Rates for October 2023. Retrieved from https://www.bankrate.com/banking/cds/best-cd-rates/

NerdWallet. (2023). Best CD Rates – October 2023. Retrieved from https://www.nerdwallet.com/best/banking/cd-rates

CNBC. (2023). How to Choose the Best CD Account. Retrieved from https://www.cnbc.com/world/?region=world